A SCIENTIFIC APPROACH TO INVESTING

MUST YOU INVEST?

Having a nest egg gives you options (and yes, the larger your bank account, the more options). Want to switch careers, work part-time, or live in Costa Rica? Or just be sure you can maintain your current lifestyle for the rest of your life? Saving and investing today, gives you options for tomorrow.

Is Social Security Enough?

Social Security should provide some income, and perhaps you have a pension that will also help out. However, because Social Security is only enough revenue to subsist in life, your portfolio is where you will get the extra funds that add abundance.

Investing Version 1.0 and 2.0

For years, investing was thought of as picking winning stocks, and doing it at the right time. This idea of how to invest has dominated our philosophy of what we “should” do.

Investing 2.5: the four factors

Starting in the 1970s, ways to increase the returns in your portfolio started to come out in academic research.

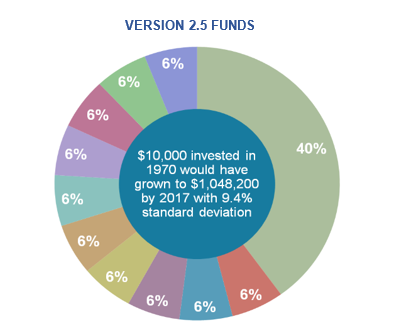

So you would be wise to use these Investing 2.5 principles when building up your portfolio. Look at the same ratio of stocks to bonds (60% stocks and 40% bonds) that we looked at in Version 2.0 Investing.

Implementing 2.5 Tilt Toward Better Performing Assets

So you would be wise to use these Investing 2.5 principles when building up your portfolio. Look at the same ratio of stocks to bonds (60% stocks and 40% bonds) that we looked at in Version 2.0 Investing.

DISCLOSURES